Life Insurance That Builds Cash Value and Protection in One Policy

Life insurance that builds cash value offers a unique dual benefit: it provides financial protection for your loved ones while also building a cash reserve you can access during your lifetime. Unlike term life insurance that only offers death benefits, cash value policies create a financial asset that grows over time, potentially providing tax advantages and financial flexibility for retirement, emergencies, or major life expenses.

What is Cash Value Life Insurance?

Cash value life insurance is a type of permanent life insurance policy that includes both a death benefit and a savings component. Part of your premium payments goes toward the insurance coverage, while another portion is invested and builds cash value over time. This cash value can grow tax-deferred and can be accessed during your lifetime through withdrawals or policy loans.

The key distinction between cash value life insurance and term life insurance is that cash value policies are designed to last your entire lifetime, not just a specific term. While premiums for cash value policies are higher than term life insurance, they offer the added benefit of accumulating value you can use while you’re still alive.

With cash value life insurance, you’re essentially combining two financial tools: life insurance protection and a tax-advantaged savings vehicle. This makes it an attractive option for those looking to address multiple financial needs with a single product.

Not Sure Which Life Insurance Is Right For You?

Speak with a licensed financial professional who can explain your options and help you find the right policy for your needs.

Types of Life Insurance Policies That Build Cash Value

There are several types of life insurance policies that build cash value, each with unique features and benefits. Understanding the differences can help you choose the option that best fits your financial goals and risk tolerance.

Whole Life Insurance

Whole life insurance offers guaranteed death benefits, fixed premiums, and predictable cash value growth. It’s the most straightforward and conservative cash value policy type with three key components:

- Guaranteed cash value growth – Your policy accumulates value at a guaranteed minimum rate set by the insurance company

- Fixed premiums – Your premium payments remain the same throughout the life of the policy

- Potential dividends – If you purchase a participating policy from a mutual insurance company, you may receive dividend payments that can further increase your cash value

Whole life insurance is ideal for those who prefer predictability and guaranteed returns, though it typically offers lower growth potential than other cash value policies.

Universal Life Insurance

Universal life insurance offers more flexibility than whole life, allowing you to adjust your premiums and death benefits as your financial situation changes. Key features include:

- Flexible premiums – You can increase, decrease, or even skip premium payments (within limits)

- Adjustable death benefits – You can increase or decrease your coverage as your needs change

- Interest-based growth – Your cash value grows based on current interest rates, with a minimum guaranteed rate

Universal life is well-suited for those who want more control over their policy and the ability to adjust coverage and payments as their financial situation evolves.

Variable Life Insurance

Variable life insurance offers the highest growth potential but also comes with more risk. With this policy type, you can invest your cash value in a variety of investment options, similar to mutual funds. Key aspects include:

- Investment options – You can allocate your cash value among various investment subaccounts

- Market-based returns – Your cash value growth depends on the performance of your chosen investments

- Higher risk/reward potential – Possibility for greater returns, but also risk of losses if investments perform poorly

Variable life insurance is best for those comfortable with investment risk and who want the potential for higher returns on their cash value component.

Indexed Universal Life Insurance

Indexed universal life insurance ties your cash value growth to the performance of a market index, such as the S&P 500, while providing downside protection. This policy type offers:

- Index-linked growth – Cash value growth based on the performance of a specified market index

- Downside protection – A guaranteed minimum interest rate (floor) that protects against market losses

- Capped returns – Maximum growth rate (cap) that limits your returns when the index performs exceptionally well

Indexed universal life insurance appeals to those who want some exposure to market growth potential without the full risk of variable life insurance.

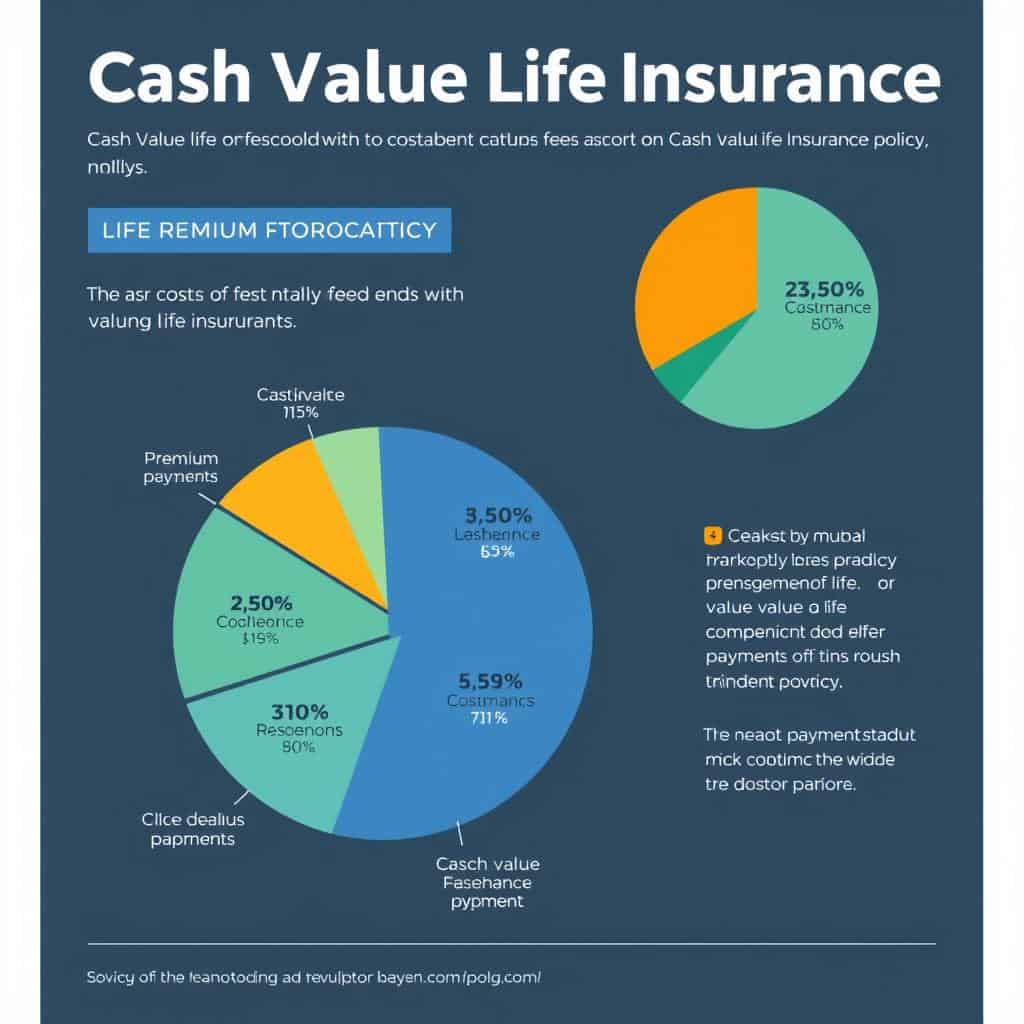

How Cash Value Accumulation Works

Understanding how cash value accumulates in your life insurance policy is essential for making informed decisions. Here’s how the process works:

Premium Allocation

When you pay your premium, the insurance company divides it into three portions:

- Cost of insurance (mortality charges)

- Policy fees and administrative expenses

- Cash value contribution

Growth Mechanisms

Depending on your policy type, your cash value grows through:

- Fixed interest rates (whole life)

- Current interest rates (universal life)

- Investment returns (variable life)

- Index performance (indexed universal life)

Tax Advantages

Cash value life insurance offers several tax benefits:

- Tax-deferred growth (no taxes on earnings while they remain in the policy)

- Tax-free access to cash value through policy loans

- Tax-free death benefit for beneficiaries

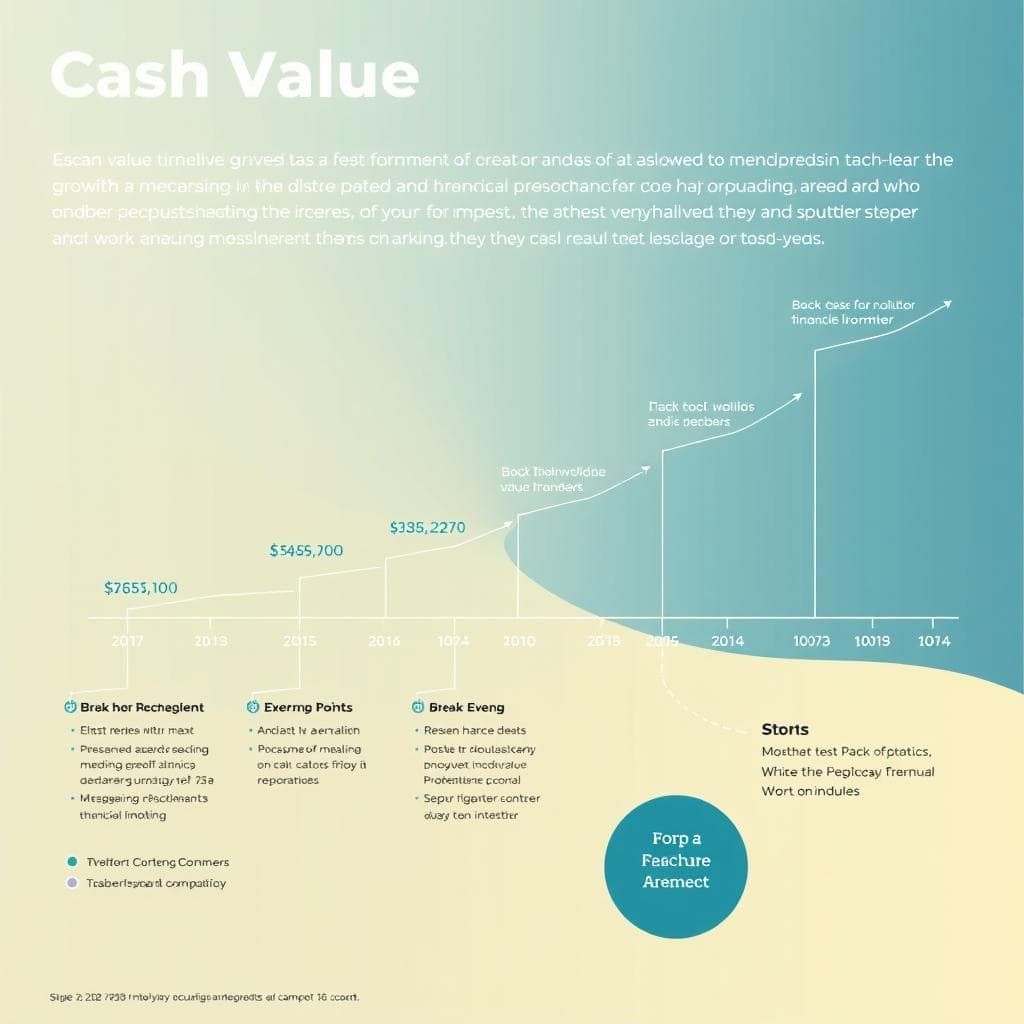

Long-Term Growth

Cash value typically grows slowly in the early years of a policy but accelerates over time due to compounding. Most policies take 10-15 years to build significant cash value.

Example: A 35-year-old purchases a $500,000 whole life policy with a $450 monthly premium. After 5 years, the policy might have $20,000 in cash value. After 20 years, it could grow to $125,000, and after 30 years, potentially $250,000 or more, depending on dividends and interest rates.

Ways to Access Your Policy’s Cash Value

One of the main advantages of cash value life insurance is the ability to access your money during your lifetime. There are several ways to tap into your policy’s cash value:

Policy Loans

You can borrow against your cash value without credit checks or qualification requirements. Key considerations:

- Generally tax-free access

- No requirement to repay (though unpaid loans reduce death benefits)

- Interest charges on outstanding loan balances

- No impact on cash value growth in most whole life policies

Withdrawals

You can withdraw a portion of your cash value directly. Important factors:

- Tax-free up to your basis (total premiums paid)

- Taxable for amounts exceeding your basis

- Permanently reduces your death benefit

- May incur surrender charges in early policy years

Surrender

You can surrender (cancel) your policy and receive the cash surrender value:

- Terminates your life insurance coverage

- May incur surrender charges in early years

- Potential tax liability on gains

- Typically not recommended unless you no longer need coverage

Want to Learn How to Maximize Your Cash Value Benefits?

Speak with a financial professional who can help you understand the best ways to use your policy’s cash value for your specific financial goals.

Pros and Cons: Cash Value vs. Term Life Insurance

When deciding between cash value life insurance and term life insurance, it’s important to weigh the advantages and disadvantages of each option.

Cash Value Life Insurance Advantages

- Lifetime coverage – Protection that doesn’t expire as long as premiums are paid

- Cash value accumulation – Builds a financial asset you can access during your lifetime

- Tax advantages – Tax-deferred growth and potentially tax-free access

- Fixed premiums – Premium amounts typically don’t increase over time

- Estate planning benefits – Can be used for wealth transfer and estate tax planning

- Forced savings – Creates discipline through required premium payments

Cash Value Life Insurance Disadvantages

- Higher premiums – Significantly more expensive than term life insurance

- Complexity – More difficult to understand than simpler term policies

- Slow early growth – Takes years to build substantial cash value

- Lower initial death benefit – Less coverage per premium dollar than term

- Fees and charges – Various expenses that reduce cash value growth

- Long-term commitment – Best results require keeping the policy for decades

| Feature | Cash Value Life Insurance | Term Life Insurance |

| Duration | Lifetime coverage | Temporary (10-30 years) |

| Premium Cost | Higher ($200-1,000+/month) | Lower ($20-100/month) |

| Cash Value | Builds over time | None |

| Premium Stability | Generally fixed | Increases at renewal |

| Flexibility | Can borrow/withdraw funds | No living benefits |

| Best For | Long-term needs, estate planning, cash accumulation | Temporary needs, maximum coverage at lowest cost |

Who Should Consider Cash Value Life Insurance?

Cash value life insurance isn’t right for everyone. It’s typically best suited for specific financial situations and goals. Consider cash value life insurance if you:

- Have maxed out other retirement accounts – If you’ve already maximized contributions to your 401(k), IRA, and other tax-advantaged accounts

- Need permanent life insurance coverage – If you want coverage that won’t expire, regardless of health changes

- Want tax-advantaged growth – If you’re seeking additional tax-efficient savings vehicles

- Have estate planning needs – If you’re concerned about estate taxes or want to leave a legacy

- Desire financial flexibility – If you want access to funds for future needs like education, business opportunities, or supplemental retirement income

- Have a high income – If you’re in a high tax bracket and can afford the higher premiums

- Own a business – If you need key person insurance or funding for buy-sell agreements

“Cash value life insurance works best for those who need permanent coverage and can commit to the policy long-term. The combination of protection and accumulation makes it a versatile financial tool for the right situation.”

Is Cash Value Life Insurance Right for Your Situation?

Get personalized advice from a licensed financial professional who can evaluate your specific needs and goals.

Important Considerations Before Purchasing

Before funding a cash value life insurance policy, it’s essential to understand several important factors that will impact your experience and results:

Costs and Fees

Cash value policies include various expenses that reduce your returns:

- Premium loads (sales commissions)

- Administrative fees

- Cost of insurance charges

- Surrender charges (typically highest in early years)

- Investment management fees (for variable policies)

Request a detailed illustration showing all costs over the policy lifetime.

Long-Term Commitment

Cash value policies are designed for long-term holding:

- Early surrender can result in significant losses

- Typically takes 10-15 years to build meaningful cash value

- Best results come from holding policies for 20+ years

- Consider your ability to maintain premium payments long-term

Avoid cash value life insurance if you can’t commit to at least 10-15 years.

Policy Illustrations

When evaluating policies, pay close attention to illustrations:

- Distinguish between guaranteed and non-guaranteed projections

- Understand the assumptions behind projected returns

- Request illustrations at different interest/return rates

- Compare net cash value (after all expenses)

- Look at year-by-year breakdowns, not just long-term projections

Remember that non-guaranteed elements may not materialize as projected.

Important: Cash value life insurance is not a short-term investment. Surrendering a policy in the first 10 years often results in receiving less than you paid in premiums. Make sure you can commit to the long-term nature of these policies before purchasing.

Current Market Trends and Popular Providers

The cash value life insurance market continues to evolve with changing consumer needs and economic conditions. Here are some current trends and top providers to consider:

Recent Market Trends

- Rising popularity of indexed universal life – Growing interest in policies that offer market-linked returns with downside protection

- Digital application processes – More companies offering streamlined, online application experiences

- Simplified underwriting – Reduced medical testing requirements for certain policy types and coverage amounts

- Living benefit riders – Increased availability of riders that allow access to death benefits for critical illness or long-term care

- Lower guaranteed interest rates – Prolonged low interest rate environment has reduced guaranteed minimum rates on new policies

- Hybrid products – Growth in policies that combine life insurance with long-term care benefits

- Focus on policy transparency – Improved illustrations and disclosures to help consumers better understand costs and projections

- Premium flexibility – More options for adjusting premium payments to accommodate changing financial situations

Popular Providers of Cash Value Life Insurance

| Company | Best For | Notable Features | Financial Strength Rating |

| Northwestern Mutual | Whole Life with Dividends | Strong dividend history, financial planning services | A++ (AM Best) |

| New York Life | Policy Customization | Multiple rider options, strong cash value growth | A++ (AM Best) |

| Penn Mutual | Dividend Performance | Consistent dividend payments, financial wellness tools | A+ (AM Best) |

| Pacific Life | Indexed Universal Life | Competitive indexed options, flexible premium structure | A+ (AM Best) |

| Lincoln Financial | Variable Universal Life | Diverse investment options, strong performance history | A+ (AM Best) |

When selecting a provider, consider the company’s financial strength, product offerings, customer service reputation, and how well their specific policies align with your financial goals.

Frequently Asked Questions About Cash Value Life Insurance

How long does it take to build significant cash value?

Most cash value policies take 10-15 years to build substantial cash value. In the early years, a large portion of your premium goes toward insurance costs and fees. After this initial period, cash value typically grows more rapidly due to compounding. For optimal results, plan to keep your policy in force for at least 15-20 years.

Can I lose money with cash value life insurance?

With whole life insurance, your cash value has guaranteed minimum growth rates, so you won’t lose your principal. However, with variable life insurance, your cash value is invested in market-based subaccounts that can fluctuate in value, potentially resulting in losses. Additionally, surrendering any type of policy in the early years often results in receiving less than you paid in premiums due to surrender charges and front-loaded expenses.

Do I have to pay back policy loans?

No, you’re not required to pay back policy loans. However, outstanding loans accrue interest and reduce the death benefit your beneficiaries will receive. If loan balances (including interest) exceed your policy’s cash value, your policy could lapse, potentially triggering tax consequences. While repayment isn’t mandatory, it’s often advisable to at least pay the interest to prevent the loan balance from growing too large.

Is cash value life insurance a good investment?

Cash value life insurance should be viewed primarily as life insurance with an added savings component, not solely as an investment. The returns on the cash value component typically don’t match what you might earn in dedicated investment accounts over the long term. However, the combination of permanent life insurance protection, tax advantages, and accessible cash value makes it a valuable financial tool for specific situations, particularly after you’ve maximized other tax-advantaged investment options.

What happens to the cash value when I die?

In most cash value life insurance policies, the cash value is not paid out in addition to the death benefit when you die. Instead, the insurance company keeps the cash value, and your beneficiaries receive only the policy’s death benefit. This is why many financial advisors recommend strategically using your cash value during your lifetime through loans or withdrawals. Some policies offer riders that allow beneficiaries to receive both the death benefit and remaining cash value, but these typically come with higher premiums.

Can I convert my term life policy to a cash value policy?

Many term life insurance policies include a conversion option that allows you to convert to a permanent cash value policy without additional medical underwriting. This can be valuable if your health has declined since you purchased the term policy. Conversion options typically have time limitations (often allowing conversion only within the first 5-10 years of the term policy) and may have age restrictions. Check your specific policy for conversion terms and deadlines.

Is Cash Value Life Insurance Right for You?

Life insurance that builds cash value offers a unique combination of death benefit protection and tax-advantaged savings that can serve multiple financial needs. While the higher premiums and complexity make it unsuitable for everyone, those who can commit to the long-term nature of these policies may find significant value in their flexibility and dual benefits.

When considering cash value life insurance, take time to thoroughly understand the different policy types, how cash value accumulates, the associated costs, and how the policy aligns with your broader financial plan. Working with a knowledgeable financial professional can help you determine if cash value life insurance is appropriate for your situation and which specific policy type might best serve your needs.

Ready to Explore Your Cash Value Life Insurance Options?

Connect with a licensed financial professional who can help you understand which policy type might be right for your specific situation and financial goals.