Best Life Insurance for Type 2 Diabetics: A 2026 Guide to Getting Covered

If you’re living with Type 2 diabetes and searching for life insurance, you might worry about facing rejection or sky-high premiums. The good news? Securing affordable coverage is more accessible than many believe. Insurance companies have evolved their approach to diabetes, and with proper management, many Type 2 diabetics qualify for standard or even preferred rates. This comprehensive guide will walk you through everything you need to know about finding the best life insurance for Type 2 diabetics in 2026.

We’ll explore how insurance companies evaluate your condition, which providers offer the most competitive rates for diabetics, and practical strategies to improve your chances of approval at favorable terms. Whether you’ve been recently diagnosed or have been managing diabetes for years, this guide will help you navigate the insurance landscape with confidence.

How Insurance Companies Evaluate Type 2 Diabetes

Insurance underwriters evaluate several factors when assessing applications from people with Type 2 diabetes

Understanding how insurance companies evaluate your diabetes is crucial to finding the best coverage. Insurers use a process called underwriting to assess your risk level, which determines your eligibility and premium rates. For Type 2 diabetics, several key factors come into play:

Key Factors in Diabetes Underwriting

HbA1c Levels

Your glycated hemoglobin (HbA1c) level is perhaps the most critical factor insurers consider. This blood test shows your average blood sugar levels over the past 2-3 months. Most insurance companies prefer to see HbA1c levels below 7.0%, though some may accept levels up to 8.5%. Lower levels demonstrate better control of your diabetes and can significantly improve your rates.

Age at Diagnosis

Being diagnosed later in life (after age 50) is viewed more favorably than an early-age diagnosis. This is because long-term diabetes carries higher risks of complications. If you were diagnosed recently and maintain good control, you’ll likely receive better rates.

Treatment Methods

How you manage your diabetes matters. Diet and exercise alone is viewed most favorably, followed by oral medications. Insulin dependence typically results in higher premiums, though this isn’t always the case with newer underwriting approaches.

Overall Health Profile

Insurers look beyond just your diabetes. They evaluate your:

- Blood pressure (ideally below 140/90)

- Cholesterol levels

- Body Mass Index (BMI)

- Kidney function

- Smoking status (non-smokers receive significantly better rates)

Diabetes-Related Complications

The presence of complications such as retinopathy, neuropathy, or cardiovascular issues will impact your rates. Regular check-ups that confirm no complications can work in your favor during the application process.

Compliance with Medical Care

Evidence that you regularly see your doctor, take prescribed medications, and follow treatment recommendations demonstrates responsibility and can positively influence underwriting decisions.

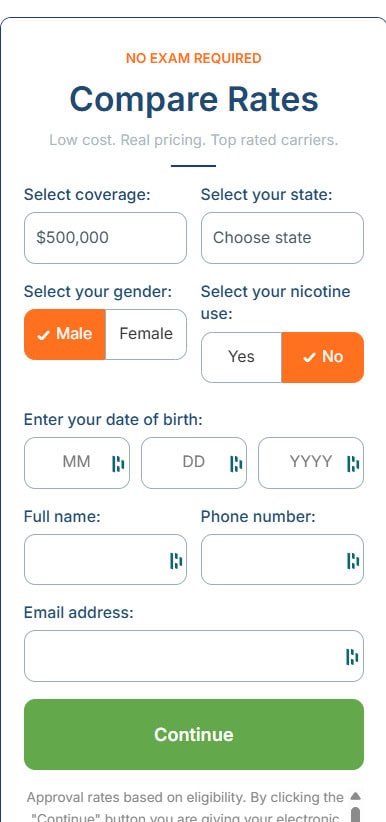

Ready to Find Your Best Rate?

Compare personalized quotes from top insurers that specialize in covering Type 2 diabetics.

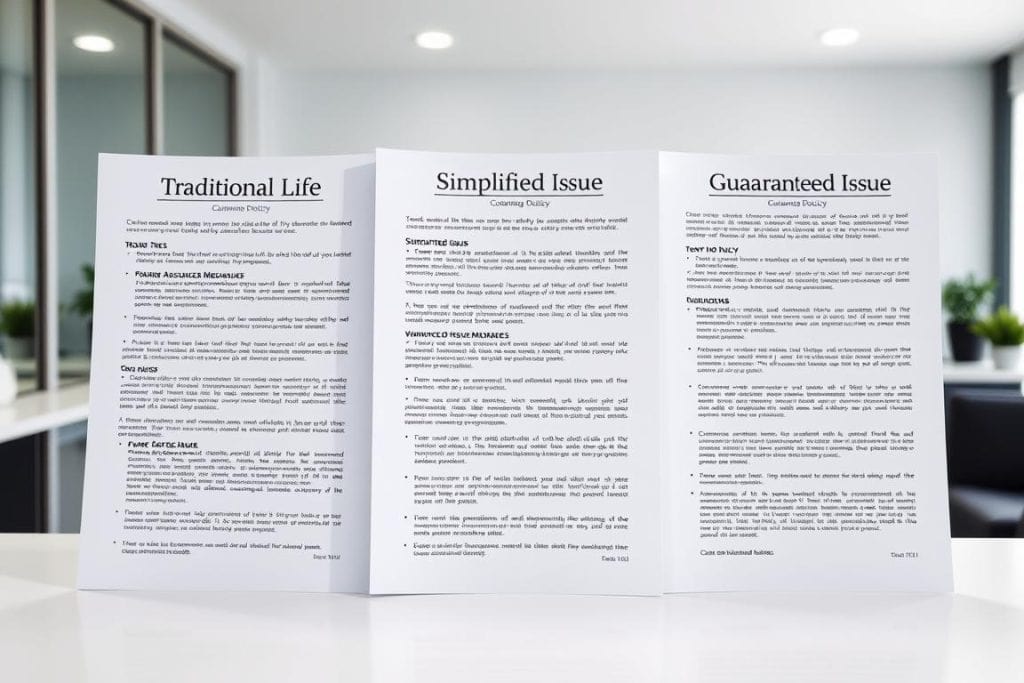

Types of Life Insurance Policies Available for Diabetics

Type 2 diabetics have several life insurance options, each with distinct advantages depending on your health status and coverage needs. Understanding these options will help you make an informed decision about which type of policy best suits your situation.

Traditional Term Life Insurance

Term life insurance provides coverage for a specific period (typically 10, 15, 20, or 30 years) and offers the highest coverage amounts at the lowest cost. For well-managed Type 2 diabetes with no complications, this is often the ideal choice.

Pros:

- Most affordable option per coverage dollar

- Higher coverage amounts available (up to millions)

- Level premiums throughout the term

Cons:

- Requires medical exam and detailed health history

- Coverage expires after the term

- Renewal rates increase significantly with age

Best for: Type 2 diabetics with well-controlled HbA1c levels (under 7.5%), no complications, and diagnosed after age 50.

Simplified Issue Life Insurance

Simplified issue policies require no medical exam but do include health questions. These policies strike a balance between convenience and cost, making them suitable for diabetics with moderate control.

Pros:

- No medical exam required

- Faster approval process (days instead of weeks)

- Available as both term and permanent policies

Cons:

- Higher premiums than fully underwritten policies

- Lower coverage limits (typically $500,000 maximum)

- Still includes health questions that could lead to denial

Best for: Type 2 diabetics with moderate control (HbA1c between 7.5-8.5%), minor complications, or those who need coverage quickly.

Guaranteed Issue Life Insurance

Guaranteed issue policies accept all applicants regardless of health status, with no medical exam or health questions. While convenient, they come with significant limitations.

Pros:

- Guaranteed approval regardless of diabetes control

- No health questions or medical exams

- Fixed premiums for life

Cons:

- Much higher premiums per coverage dollar

- Low coverage limits (typically $25,000-$50,000)

- Graded death benefits (full payout only after 2-3 years)

Best for: Type 2 diabetics with poor control (HbA1c above 8.5%), significant complications, or those who have been declined for other policies.

Permanent Life Insurance Options

Whole Life Insurance

Whole life provides lifelong coverage with fixed premiums and builds cash value over time. For diabetics who can qualify, it offers the security of permanent protection that never expires, though at a higher cost than term insurance.

Many whole life policies for diabetics include dividend options that can be used to increase coverage, reduce premiums, or build additional cash value. Some insurers offer special whole life products designed specifically for people with chronic conditions like diabetes.

Universal Life Insurance

Universal life offers more flexibility than whole life, allowing you to adjust premiums and death benefits as your needs change. This can be advantageous for diabetics whose health status improves over time.

Some universal life policies include living benefits that allow early access to death benefits if you develop certain critical illnesses or require long-term care. This feature can be particularly valuable for diabetics concerned about future complications.

Important Note: Regardless of which policy type you choose, working with an independent agent who specializes in high-risk cases can significantly improve your chances of finding affordable coverage. These specialists know which companies are most favorable toward diabetics and can guide you through the application process.

Top Life Insurance Companies for Type 2 Diabetics in 2026

Not all insurance companies evaluate diabetes the same way. Some offer significantly better terms for Type 2 diabetics than others. Based on our research, these five companies consistently provide the most favorable rates and terms for people with Type 2 diabetes.

John Hancock

John Hancock stands out with its innovative Aspire program specifically designed for people with diabetes. This program offers significant benefits that can make a real difference in both coverage and cost.

Pros

- Aspire program offers up to 25% premium discounts for well-managed diabetes

- Provides free blood glucose monitoring equipment

- Access to health coaches specializing in diabetes management

- Rewards for healthy behaviors like exercise and nutritious eating

- May consider Type 2 diabetics for Standard Plus rates

Cons

- Higher base premiums than some competitors

- Program participation requires sharing health data

- Not available in all states

Best For: Type 2 diabetics who actively manage their condition and are willing to participate in a wellness program to earn discounts.

Get a Personalized Quote from John Hancock

See how their Aspire program can help you save up to 25% on your premiums.

Banner Life (Legal & General America)

Banner Life consistently offers some of the most competitive rates for Type 2 diabetics, particularly for those with well-controlled conditions. Their underwriting guidelines are more lenient than many competitors.

Pros

- Consistently lower premiums for diabetics compared to competitors

- May consider Type 2 diabetics for Standard Plus rates

- Accepts applicants with A1C levels up to 8.0 without complications

- Offers term lengths up to 40 years

- Strong financial stability (A+ rating from AM Best)

Cons

- No specialized diabetes management program

- Medical exam required for all diabetic applicants

- Limited permanent life insurance options

Best For: Type 2 diabetics seeking the most affordable term life insurance rates, especially those diagnosed after age 50 with good control.

Compare Banner Life Rates

See how much you could save with Banner Life’s diabetic-friendly policies.

Prudential

Prudential has earned a reputation for being one of the most accommodating insurers for people with various health conditions, including Type 2 diabetes. Their underwriting approach focuses on the overall picture rather than just the diagnosis.

Pros

- More lenient with recently diagnosed Type 2 diabetics

- Considers applicants with A1C levels up to 8.5

- May offer Standard rates even with insulin use

- Wide range of policy options and riders

- Strong financial ratings and established reputation

Cons

- Higher premiums than some competitors

- Stricter on diabetics with other health issues

- Application process can be lengthy

Best For: Recently diagnosed Type 2 diabetics or those who use insulin but otherwise have good control and minimal complications.

Explore Prudential’s Diabetic-Friendly Options

Find out if their flexible underwriting approach can work for your situation.

Mutual of Omaha

Mutual of Omaha offers a good balance of traditional policies and no-exam options, making them versatile for diabetics with varying health profiles. Their guaranteed issue policies can be a good fallback for those who don’t qualify for standard coverage.

Pros

- Offers both traditional and no-exam policy options

- Guaranteed issue whole life available regardless of diabetes control

- Living benefits included on many policies

- Strong customer service ratings

- Competitive rates for diabetics over age 60

Cons

- Less competitive rates for younger diabetics

- Guaranteed issue policies have low coverage limits

- More strict on insulin-dependent Type 2 diabetes

Best For: Older Type 2 diabetics (60+) and those who may not qualify for fully underwritten policies but need guaranteed coverage.

Get Guaranteed Coverage from Mutual of Omaha

No medical exam required – acceptance guaranteed regardless of your diabetes status.

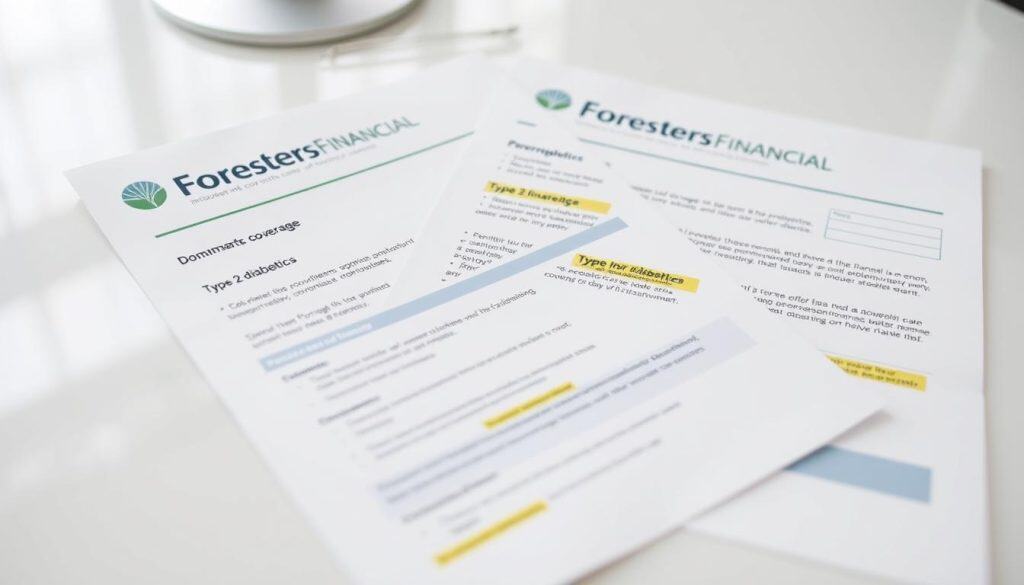

Foresters Financial

Foresters Financial offers competitive simplified issue policies that can be excellent options for Type 2 diabetics who want to avoid medical exams. Their fraternal benefits also provide additional value beyond just the death benefit.

Pros

- Excellent simplified issue options with no medical exam

- Competitive rates for moderate diabetes control

- Additional member benefits beyond insurance

- Quick approval process (often within days)

- Living benefits included at no extra cost

Cons

- Lower coverage limits than fully underwritten policies

- Less name recognition than larger insurers

- Fewer policy customization options

Best For: Type 2 diabetics seeking no-exam coverage with faster approval and additional membership benefits.

Skip the Medical Exam with Foresters Financial

Get coverage in days instead of weeks – no needles, no blood tests.

| Insurance Company | Best For | A1C Threshold | No-Exam Options | Best Available Rate Class |

| John Hancock | Active diabetes management | Up to 7.5% | Limited | Standard Plus |

| Banner Life | Affordable term coverage | Up to 8.0% | No | Standard Plus |

| Prudential | Recently diagnosed/insulin users | Up to 8.5% | Limited | Standard |

| Mutual of Omaha | Seniors & guaranteed coverage | Up to 8.0% (or any for guaranteed) | Yes | Standard |

| Foresters Financial | No-exam coverage | Up to 8.0% | Yes | Standard |

Actionable Tips for Applying with Type 2 Diabetes

The application process can be daunting, especially when you have a pre-existing condition like Type 2 diabetes. These practical tips will help you prepare effectively and maximize your chances of approval at the best possible rates.

Before You Apply

Optimize Your Health

Take steps to get your diabetes under the best possible control before applying:

- Work with your doctor to lower your A1C levels

- Maintain consistent blood sugar readings

- Follow your medication regimen precisely

- Improve other health markers (blood pressure, cholesterol, weight)

- If you smoke, quit at least 12 months before applying

Gather Your Medical Information

Collect comprehensive records to demonstrate responsible management:

- Complete medical history, especially related to diabetes

- List of all medications and dosages

- Recent lab results, particularly A1C tests

- Names and contact information for all healthcare providers

- Dates of any diabetes-related complications or hospitalizations

Research Companies and Policies

Not all insurers view diabetes the same way:

- Focus on companies known for diabetic-friendly underwriting

- Compare policy features beyond just the premium

- Consider working with an independent agent who specializes in high-risk cases

- Get preliminary quotes from multiple providers

Time Your Application Strategically

When you apply can impact your approval odds:

- Apply after several months of stable A1C readings

- Schedule any medical exam in the morning after fasting

- Avoid applying immediately after a medication change

- Consider postponing if you’ve recently had unstable readings

During the Application Process

Be Completely Honest

Transparency is crucial when applying with diabetes:

- Never withhold information about your condition

- Disclose all medications, even if not directly related to diabetes

- Be forthcoming about any complications or hospitalizations

- Provide accurate dates of diagnosis and treatment changes

Prepare for the Medical Exam

If your policy requires an exam, take these steps:

- Fast for 8-12 hours before the exam

- Avoid caffeine, alcohol, and strenuous exercise for 24 hours prior

- Take medications as prescribed

- Get a good night’s sleep before the exam

- Stay well-hydrated (but avoid excessive water right before)

Highlight Positive Factors

Draw attention to aspects that demonstrate responsible management:

- Regular doctor visits and compliance with treatment

- Consistent monitoring of blood sugar levels

- Healthy lifestyle habits (exercise, diet, non-smoking)

- Stable or improving A1C trends

- Absence of complications

Be Patient and Persistent

The process may take longer for diabetic applicants:

- Expect additional questions about your condition

- Be prepared for requests for more medical records

- Don’t get discouraged by initial high quotes or rejections

- Consider alternative companies if one denies coverage

- Ask about policy reconsideration if your health improves

“The key to success when applying for life insurance with Type 2 diabetes is preparation. Gather all your medical information, work with your doctor to optimize your health metrics, and partner with an agent who specializes in high-risk cases. This approach can make the difference between denial and approval—or between standard and preferred rates.”

Ready to Apply with Confidence?

Our specialists can help you navigate the application process and find the best coverage for your specific situation.

Sample Life Insurance Rates for Type 2 Diabetics

To give you a realistic expectation of costs, we’ve compiled sample monthly premium rates for Type 2 diabetics with varying health profiles. Remember that actual rates will depend on your specific situation, and working with an independent agent can help you find the best pricing.

20-Year Term Life Insurance ($250,000 Coverage)

| Age | Excellent Control (A1C under 7.0%) |

Good Control (A1C 7.0-7.9%) |

Moderate Control (A1C 8.0-8.5%) |

| 40-49 | $30-45/month | $45-65/month | $65-90/month |

| 50-59 | $70-95/month | $95-130/month | $130-180/month |

| 60-65 | $140-190/month | $190-250/month | $250-350/month |

Factors That Impact Your Rate

Age at Diagnosis

Being diagnosed after age 50 can result in rates 20-40% lower than those diagnosed before age 40, all other factors being equal. This is because later-onset diabetes typically progresses more slowly and has fewer long-term complications.

Treatment Method

Diet and exercise management alone can qualify for rates 30-50% lower than insulin-dependent diabetes. Oral medications typically fall in between, with metformin viewed more favorably than other medications.

Duration of Diabetes

Recently diagnosed diabetics (less than 5 years) with good control may receive rates 15-25% lower than those who have had diabetes for 10+ years, reflecting the lower risk of complications in early stages.

Important: These rates are estimates based on non-smoking applicants with no other significant health issues. Tobacco use typically doubles premiums, while additional health concerns like high blood pressure or high cholesterol can increase rates by 20-50%.

Simplified Issue Life Insurance ($100,000 Coverage)

| Age | Good Control (No Complications) |

Moderate Control (Minor Complications) |

| 40-49 | $40-60/month | $60-85/month |

| 50-59 | $75-110/month | $110-150/month |

| 60-65 | $150-200/month | $200-275/month |

Guaranteed Issue Whole Life ($25,000 Coverage)

| Age | Monthly Premium (Any Health Status) |

| 50-59 | $75-110/month |

| 60-69 | $110-160/month |

| 70-75 | $160-225/month |

Find Your Actual Rate

Get personalized quotes based on your specific health profile and coverage needs.

Frequently Asked Questions About Life Insurance for Type 2 Diabetics

Can I get life insurance if I have Type 2 diabetes?

Yes, absolutely. Type 2 diabetes is one of the most common and insurable chronic conditions. While having diabetes may affect your rates, many insurers offer competitive policies for diabetics, especially those with good control. Even with less-than-perfect control, options like simplified issue and guaranteed issue policies are available.

Will I need to take a medical exam?

It depends on the policy type and coverage amount. Traditional term and whole life policies typically require a medical exam for diabetic applicants. However, simplified issue policies require only health questions without an exam, and guaranteed issue policies require neither exams nor health questions. Keep in mind that policies without medical exams generally offer lower coverage amounts at higher premiums.

How much will my diabetes increase my premiums?

The impact varies widely based on several factors:

- Well-controlled Type 2 diabetes (A1C under 7.0%) diagnosed after age 50 might increase premiums by only 20-50% compared to non-diabetic rates

- Moderate control (A1C 7.0-8.0%) might double your premiums

- Poor control or complications could increase rates by 200-300% or result in denial

- Insulin dependence typically results in higher rates than oral medications or diet-controlled diabetes

Working with an independent agent who specializes in high-risk cases can help you find the most competitive rates for your specific situation.

What if I was recently diagnosed with Type 2 diabetes?

Recent diagnosis (within the past year) can be viewed in different ways by insurers. Some may be cautious until you establish a track record of management, while others view new diagnoses favorably if you’ve responded well to initial treatment. If your A1C levels have stabilized quickly after diagnosis, some companies may offer standard rates. Consider waiting 6-12 months after diagnosis to apply if your control is improving, as this can result in better rates.

Can I get life insurance if I use insulin for my Type 2 diabetes?

Yes, insulin use doesn’t disqualify you from coverage, though it may limit your options and increase premiums. Companies like Prudential and John Hancock are known for more favorable consideration of insulin-dependent Type 2 diabetics. The key factors will be how long you’ve been using insulin, your dosage, and how well your blood sugar is controlled with it. Some insurers may offer standard rates for insulin users with excellent control and no complications.

What if I have complications from my diabetes?

Complications such as retinopathy, neuropathy, or kidney issues will impact your insurability and rates. Minor complications may result in higher substandard ratings, while major complications could lead to denial for traditional policies. If you have significant complications, consider:

- Simplified issue policies with limited health questions

- Guaranteed issue policies with no health questions

- Graded benefit policies that provide partial coverage initially

- Group life insurance through an employer (which may not require medical underwriting)

Can my rates be lowered if my diabetes control improves?

Yes, many insurers offer reconsideration after policy issuance if your health improves significantly. If you’ve had your policy for at least 1-2 years and can demonstrate sustained improvement in your A1C levels and overall health, you can request a rate review. Some companies, like John Hancock with their Aspire program, offer ongoing premium discounts based on continued good management of your diabetes.

Should I work with a specialized agent?

Working with an independent agent who specializes in high-risk cases, particularly diabetes, can significantly improve your chances of finding affordable coverage. These specialists:

- Know which companies have the most favorable underwriting for diabetics

- Can properly present your case to underwriters

- May have access to special programs not available to the general public

- Can help you prepare for medical exams and applications

- Can compare rates across multiple providers to find the best deal

Still Have Questions?

Our diabetes insurance specialists can provide personalized answers to your specific situation.

Conclusion: Securing Your Family’s Future Despite Type 2 Diabetes

Living with Type 2 diabetes doesn’t mean you have to go without the financial protection that life insurance provides. As we’ve seen throughout this guide, many insurers now offer competitive coverage options for diabetics, especially those who actively manage their condition.

The key to success lies in preparation, persistence, and partnership with the right professionals. By understanding how insurers evaluate diabetes, optimizing your health before applying, gathering comprehensive medical records, and working with specialists who know which companies offer the best terms for your specific situation, you can secure the coverage your loved ones deserve.

Remember that each insurance company evaluates diabetes differently. What might result in a denial or high rates from one provider could receive standard rates from another. This makes comparison shopping essential, ideally with the help of an independent agent who specializes in high-risk cases.

Most importantly, don’t let concerns about your diabetes prevent you from seeking coverage. With proper management and the right approach to the application process, affordable life insurance is within reach. Take the first step today toward protecting your family’s financial future.

Take Action Today

Compare personalized quotes from top insurers that specialize in covering Type 2 diabetics.